Overview of Generative AI

Generative AI represents a subset of artificial intelligence that focuses on creating new content, including text, images, and complex data models. Unlike traditional AI, which typically classifies or analyzes existing data, Generative AI produces new data based on patterns learned from existing datasets. This ability to generate novel, high-quality content has significant implications across various industries, particularly in healthcare, where it can drive innovation in diagnostics, treatment planning, and patient care.

Importance of AI in Healthcare

The healthcare sector increasingly relies on AI to enhance decision-making, optimize processes, and improve patient outcomes. From automating routine tasks to providing predictive insights, AI transforms how healthcare providers diagnose, treat, and interact with patients. Integrating AI into healthcare streamlines operations and addresses critical challenges, such as the need for personalized care and the management of large volumes of medical data. Generative AI, with its unique capability to create and innovate, adds a new dimension to this transformation, offering solutions that are both creative and impactful.

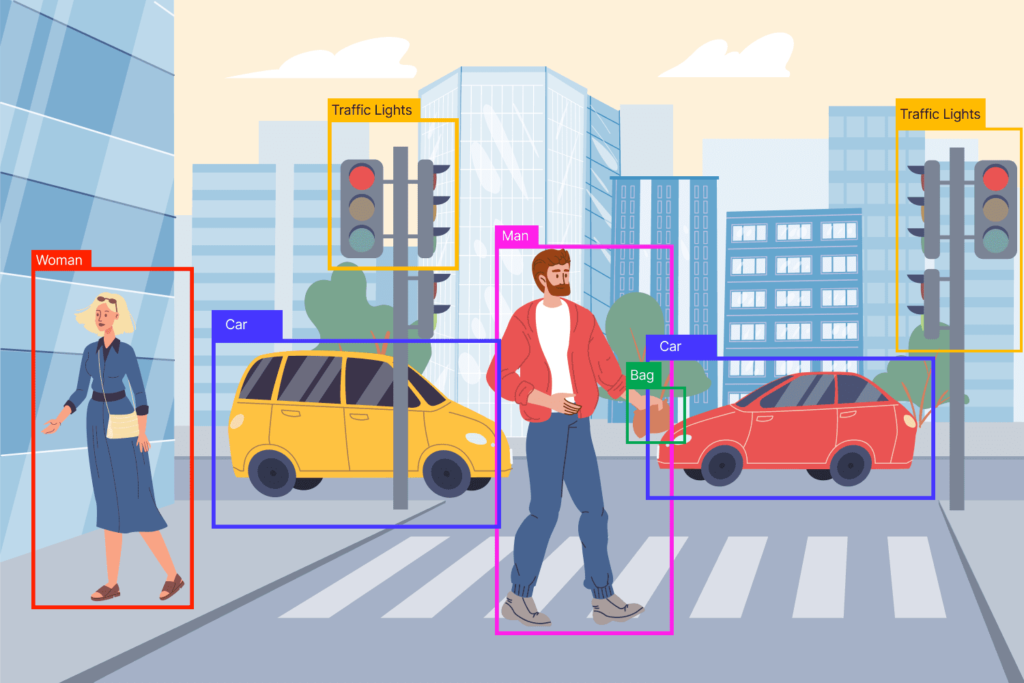

Generative AI in Diagnostics and Imaging

AI-Powered Imaging:

Generative AI is revolutionizing medical imaging by enhancing techniques like MRI, CT scans, and X-rays. Traditional imaging methods rely on manual interpretation by radiologists, which can be time-consuming and subject to human error. Generative AI algorithms can quickly process vast amounts of imaging data, identifying patterns and anomalies with unprecedented accuracy. For instance, AI-powered tools can improve image resolution, remove noise, and generate 3D models from 2D images, providing healthcare professionals with clearer, more detailed visualizations. This enhancement allows for more accurate diagnoses, particularly in complex cases where subtle differences in tissue or organ structures must be detected.

Early Detection:

One of the most significant advantages of using Generative AI in diagnostics is its ability to detect diseases at an early stage, often before symptoms become apparent. Early detection is crucial in conditions like cancer, where the prognosis improves dramatically with early intervention. Generative AI models trained on large datasets of medical images can identify early signs of diseases that the human eye might miss. For example, AI can analyze mammograms to detect early-stage breast cancer or process lung scans to identify tiny nodules indicative of early lung cancer. By flagging these early signs, Generative AI empowers healthcare providers to initiate treatment sooner, potentially saving lives and reducing the overall burden of disease.

Case Studies:

Several successful implementations of Generative AI in medical diagnostics highlight its transformative potential. For example:

Lung Cancer Detection: A study conducted by researchers at Google Health demonstrated that their AI system could detect lung cancer more accurately than radiologists. The AI model, trained on thousands of lung scans, was able to identify cancerous nodules that were previously overlooked, leading to earlier and more accurate diagnoses.

Breast Cancer Screening: The UK's National Health Service (NHS) has integrated AI into its breast cancer screening program. The AI system analyzes mammograms and has been shown to reduce the number of false positives and false negatives, improve the accuracy of screenings, and reduce unnecessary biopsies.

Diabetic Retinopathy: In India, an AI-based diagnostic tool has been deployed to screen patients for diabetic retinopathy, which can lead to blindness if not detected early. The AI system quickly analyzes retinal images and identifies the presence and severity of the disease, allowing for timely treatment.

Personalized Medicine and Treatment Plans

AI in Drug Discovery:

Generative AI is dramatically accelerating the process of drug discovery and development, a traditionally lengthy and expensive endeavor. By analyzing vast datasets of chemical compounds, biological interactions, and genetic information, AI can identify potential drug candidates more quickly and accurately than traditional methods. Generative models can predict how different molecules will interact with specific targets, suggesting novel compounds that might be effective against diseases. This capability shortens the drug development timeline by reducing the need for extensive laboratory testing and allows researchers to explore a broader range of possibilities. For instance, AI-driven drug discovery has been pivotal in developing treatments for diseases like COVID-19, where speed was essential.

Tailored Treatments:

Generative AI is crucial in creating personalized treatment plans tailored to individual patients. By leveraging patient-specific data, including genetic information, medical history, lifestyle factors, and even real-time health metrics, AI can predict how a patient will respond to various treatment options. This approach allows healthcare providers to move beyond one-size-fits-all treatments and develop optimized strategies for each patient's needs. For example, in oncology, AI can help design personalized cancer therapies that target specific genetic mutations in a patient's tumor, improving the effectiveness of the treatment while minimizing side effects. Similarly, in chronic disease management, AI can suggest lifestyle modifications and medication adjustments that are personalized to the patient's condition and behavior.

Improving Patient Outcomes:

The application of Generative AI in personalized medicine has profound implications for patient outcomes. By providing more accurate diagnoses, recommending targeted therapies, and predicting potential complications, AI helps healthcare providers deliver more effective and efficient care. Personalized treatment plans reduce the trial-and-error approach often associated with traditional medicine, leading to faster recovery times and improved quality of life for patients. Moreover, AI-driven insights enable proactive care, identifying and addressing potential health issues before they escalate into serious problems. This shift from reactive to proactive healthcare enhances patient outcomes and contributes to long-term health and wellness. The ultimate benefit of personalized medicine is a more patient-centered approach, where care is more effective and aligned with individual patient preferences and needs.

Enhancing Patient Care and Experience

Virtual Health Assistants:

Generative AI is at the forefront of improving patient care through AI-driven chatbots and virtual health assistants. These digital assistants can interact with patients in real time, providing information, answering questions, and even offering preliminary diagnoses based on symptoms described by the patient. They are available 24/7, ensuring that patients can access reliable medical advice whenever needed. For example, a patient experiencing symptoms can interact with a virtual assistant to determine whether they need immediate medical attention or if self-care at home is sufficient. These AI-driven tools also help manage appointments, remind patients to take medications, and provide personalized health tips, making healthcare more accessible and convenient.

AI in Telemedicine:

Generative AI is revolutionizing telemedicine by enhancing the quality and effectiveness of remote consultations. With AI-driven platforms, doctors can analyze patient data, including medical history, current symptoms, and even real-time biometric data, to make more accurate diagnoses without needing an in-person visit. Generative AI can also simulate potential disease progressions, helping doctors anticipate complications and adjust treatment plans accordingly. This capability is particularly valuable in rural or underserved areas with limited access to healthcare facilities. Additionally, AI-powered telemedicine platforms can translate medical records, interpret lab results, and generate patient interaction summaries, ensuring that patients and doctors have all the necessary information to make informed decisions.

Patient Monitoring and Management:

Generative AI is transforming chronic disease management through continuous health monitoring. Wearable devices and smart sensors can collect data on various health metrics such as heart rate, blood pressure, glucose levels, etc. AI systems analyze this data in real-time, detecting patterns and anomalies that might indicate a worsening condition. For example, in managing diabetes, AI can monitor a patient's glucose levels continuously, predict potential spikes or drops, and recommend dietary or medication adjustments before the situation becomes critical. This proactive approach helps prevent complications and ensures patients with chronic conditions maintain better control over their health. AI-driven monitoring also enables healthcare providers to stay connected with patients, offering timely interventions when necessary and providing more personalized care.

Streamlining Healthcare Operations

Administrative Efficiency:

Generative AI significantly enhances healthcare administrative efficiency by automating a wide range of routine tasks, including scheduling, billing, and documentation. Traditionally, these tasks required substantial manual effort, often leading to delays, errors, and increased operational costs. AI-driven systems can now handle these responsibilities with greater accuracy and speed. For instance, AI can automate appointment scheduling by analyzing doctor availability and patient preferences, reducing the risk of double bookings or missed appointments. In billing, AI can process insurance claims, detect discrepancies, and ensure accurate billing, minimizing errors that could lead to costly disputes. Additionally, AI can automate the generation and management of medical records, ensuring that all patient information is up-to-date and easily accessible, improving overall administrative workflow, and allowing healthcare providers to focus more on patient care.

Resource Management:

Efficient resource management is crucial in hospitals and healthcare facilities, where the timely allocation of staff, equipment, and rooms can directly impact patient outcomes. Generative AI helps optimize resource allocation by predicting patient flow, bed occupancy, and staffing needs based on historical data and real-time analytics. For example, AI can forecast patient admission rates during peak seasons or predict the need for specific medical equipment based on current patient conditions. This allows hospitals to allocate resources more effectively, ensuring that critical areas are well-staffed and equipped. AI can also assist in managing inventory by predicting the usage of medical supplies and medications, reducing waste, and ensuring that necessary resources are always available. By optimizing these logistical aspects, AI ensures that healthcare facilities operate more smoothly and efficiently.

Operational Benefits:

Integrating Generative AI into healthcare operations leads to substantial cost reductions and improved operational efficiency. AI minimizes operational costs associated with manual processes and inefficiencies by automating routine tasks, optimizing resource management, and reducing errors. For instance, AI-driven predictive medical equipment maintenance can prevent costly breakdowns and extend the lifespan of expensive machinery. Furthermore, by streamlining administrative processes and reducing the burden on healthcare staff, AI contributes to a more productive work environment, leading to faster patient throughput and reduced wait times. These operational improvements save money and enhance the quality of care, making healthcare services more accessible and affordable. Ultimately, adopting AI in healthcare operations creates a more sustainable healthcare system that can better meet the population's growing demands.

Challenges and Ethical Considerations

Data Privacy and Security:

One of the most pressing challenges in deploying Generative AI in healthcare is ensuring the privacy and security of patient data. Healthcare data is highly sensitive, encompassing personal identifiers, medical histories, genetic information, etc. AI requires vast amounts of this data to train models, which raises significant concerns about how this information is stored, accessed, and used. Cybersecurity threats, such as data breaches and unauthorized access, can expose confidential patient information, potentially resulting in identity theft or other forms of exploitation. To address these concerns, healthcare organizations must implement robust security measures like encryption, access controls, and regular audits. Additionally, AI must comply with data protection regulations like the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. or the General Data Protection Regulation (GDPR) in Europe, ensuring that patient data is handled with the utmost care and respect.

Bias in AI:

Bias in AI algorithms is another critical issue that can seriously affect healthcare decisions. AI models are trained on historical data, which may reflect existing biases in the healthcare system, such as disparities in treatment based on race, gender, or socioeconomic status. If not carefully managed, AI can perpetuate or even exacerbate these biases, leading to unequal treatment outcomes. For example, an AI model trained predominantly on data from one demographic group might underperform when used with patients from different backgrounds, resulting in misdiagnoses or inappropriate treatment recommendations. To mitigate these risks, it is essential to ensure that AI models are trained on diverse, representative datasets and regularly tested for bias. Additionally, transparency in AI decision-making processes and the involvement of diverse stakeholders in developing and deploying AI systems are crucial in addressing and correcting biases.

Regulatory and Ethical Issues:

The rapid advancement of AI in healthcare has outpaced the development of comprehensive regulatory frameworks and ethical guidelines. This gap creates uncertainty about the appropriate use of AI, particularly in high-stakes areas like diagnosis and treatment. There is a need for clear regulations that govern AI development, testing, and deployment in healthcare to ensure that these technologies are safe, effective, and used responsibly. Ethical considerations include ensuring that AI does not replace human judgment in critical decisions and that patients are informed about using AI in their care. Consent is another key ethical issue, as patients must know how their data is used and have the right to opt out. Regulatory bodies, healthcare providers, and AI developers must collaborate to establish standards that protect patient rights while allowing for innovation. This includes defining accountability, ensuring transparency in AI operations, and promoting the ethical use of AI to enhance patient care without compromising trust.

These challenges highlight the importance of careful planning, rigorous testing, and ongoing monitoring in integrating Generative AI into healthcare. Addressing these issues is crucial to ensuring that AI-driven healthcare solutions are effective but also equitable, ethical, and secure.

Future Prospects of Generative AI in Healthcare

Ongoing Research and Innovations:

Generative AI continues to be a driving force behind some of the most cutting-edge advancements in healthcare. Ongoing research is exploring the use of AI in areas such as personalized medicine, where AI can design individualized treatments based on a patient's genetic makeup and lifestyle. Another exciting area of innovation is the development of AI models capable of predicting the onset of diseases before symptoms appear, enabling preemptive care and significantly improving patient outcomes. Additionally, AI is being integrated into robotic surgery, where it can assist surgeons by providing real-time data analysis, enhancing precision, and reducing the risk of complications. The future possibilities of AI in healthcare are vast, with research exploring the potential of AI to simulate complex biological processes, create synthetic organs for transplantation, and even discover entirely new classes of drugs that could treat currently incurable diseases.

AI's Role in Global Health:

Generative AI can play a transformative role in addressing global health challenges and reducing inequalities in healthcare access. In low-resource settings, AI can overcome the lack of medical infrastructure by providing remote diagnostics, treatment recommendations, and health education through mobile platforms. AI-driven tools can also help combat infectious diseases by predicting outbreaks, tracking the spread of diseases, and optimizing vaccination strategies. Moreover, AI can support global health initiatives by analyzing large datasets to identify trends and disparities, enabling targeted interventions in underserved communities. As AI technology becomes more accessible, it could help bridge the healthcare gap between developed and developing regions, providing high-quality care to populations that have historically been underserved.

Long-term Impact:

The long-term impact of Generative AI on healthcare systems worldwide is likely to be profound. As AI becomes more integrated into everyday healthcare, it will lead to more personalized, efficient, and proactive medical care. AI could enable healthcare systems to shift from reactive treatment models to preventative care, where diseases are anticipated and managed before they become severe. This transition would not only improve patient outcomes but also reduce healthcare costs by minimizing the need for emergency care and hospitalizations. Furthermore, AI's ability to process and analyze vast amounts of data could lead to a deeper understanding of human health, uncovering new insights into disease prevention, management, and cure. However, this long-term impact will also require addressing AI's ethical, regulatory, and operational challenges, ensuring the benefits are realized equitably across all populations.

In conclusion, the future of Generative AI in healthcare holds immense promise. Continued innovation and thoughtful integration of AI into healthcare practices will likely lead to a new era of medicine, where personalized care, global health equity, and proactive health management become the norm.